Private Placement Agreement - Intasys Corp. Our core focus on every program that we work with our clients.

Private Placement Program Pdf Due Diligence Banks

It states that the trader or investment manager will use their best efforts to achieve high profits.

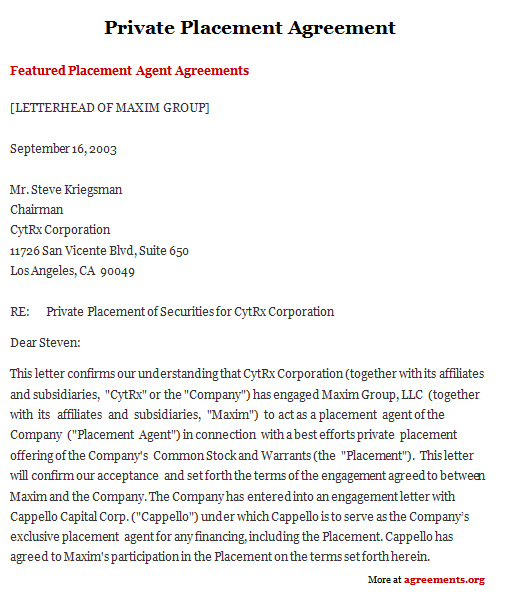

. Private placements are used by companies to raise capital from private investors often via a set of investment documents known as a Private Placement Memorandum PPM. Private Placement Programs PPPs also known under other names such as Private Placement Opportunity Programs PPOPs or Private Placement Investment Programs PPIPs PPOPs. Create on Any Device.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Fast Results Done Right. Private Placement Program PPP 100 Capital Protected Zero Risk of Capital Loss We provide 2 Private Placement Programs PPP.

Most private placement contracts are for 2 years and are renewed upon expiration if both parties choose. Thereafter a contract will be issued to the client. Once the contract has been explained and executed the trade will commence immediately.

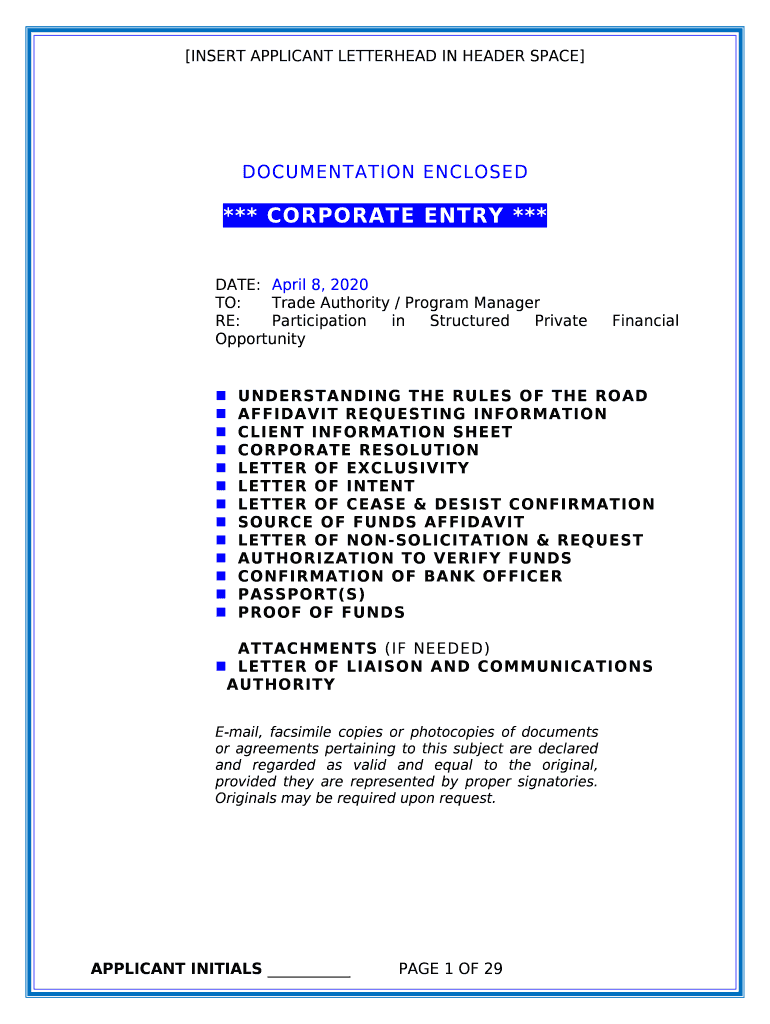

Ad High-Quality Reliable Legal Solutions Developed by Lawyers. A client with a minimum of 200M applies for a Private Placement Opportunity Program. 1 THE CLIENT PROVIDES A PROOF OF FUNDS AND PASSPORT COPY ALONG WITH THEM COMPLIANCE PACKAGE.

Free Initial Consultation with Lawyer Its not a matter of if its a matter. It refers to the investors bank reserving funds in favor of another individual without actually. This is a term used in any real private placement contract.

PPPs are also known under other names such as Private Placement Programs PPPs or Private Placement Investment Programs PPIPs. In real PPPs the investors principal investment remains either on Admin Hold or MT760 block depending on the rating of the bank for the. Steps to Private Placement Programs PPP Desk.

The following is a summary of the process involved for entering a PPP. On 100M or more the funds will remain in the. LLC Sep 16 2003.

Private placement or non-public offering is a funding round of securities which are sold not through a public offering but rather through a private offering mostly to a small number of. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Private Placement Programs PPP Explained.

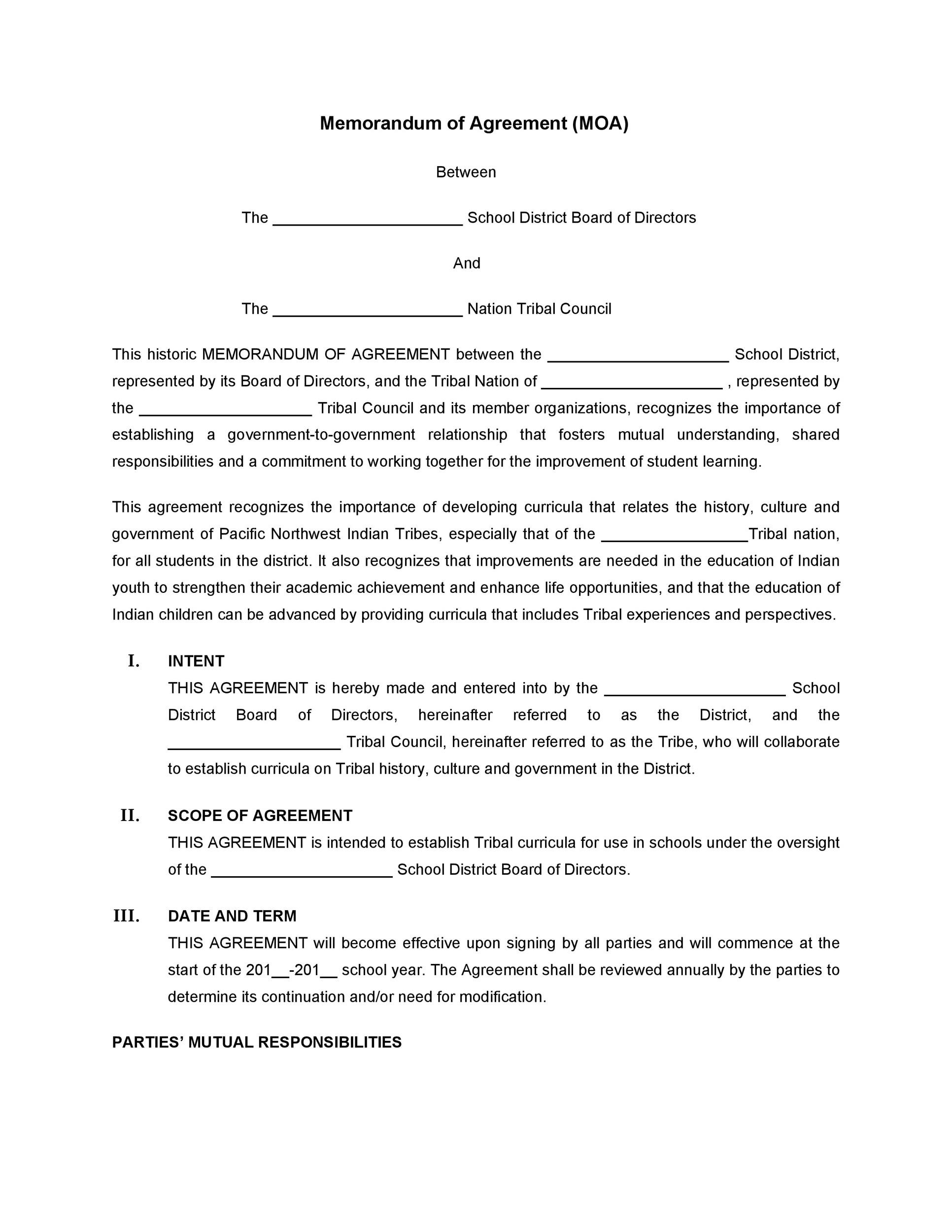

Contracts are provided to high net worth clients. Private Placement Programs PPPs. Private Placement Agent Agreement - CytRx Corp.

This is subject to change from. PRIVATE PLACEMENT PROGRAM PPP Introduction Private placement trading programs usually involves trading with Financial Instruments SBLC BG MTN SKR CD or secure deposit. Fill Out and Download Your Professional Agreement Today for Free.

And Lines Overseas Management Ltd. Ad Register and Subscribe Now to work on your CIEE Cultural Exchange Program Placement Agrmt. Clients who possess or Euro 100 million or more parked in any top commercial bank with AAA rating might qualify to place funds into a Private Placement.

Program 1 - Executive Program 2 - Platinum Minimum. We facilitate secured Private Placement Programs in direct cooperation with platform program managers and providers. Most of the assets that.

Astor Rutherford is Trader Direct for private placement programs PPP and high yield programs. A term usually used by brokers. Private Placement Program Definition.

Private Placement Agreement Download Pdf And Word Agreements Org

Private Placement Programs From 1 5 M Direct From The Trading Platform Of The Bank Pdf Free Download

Private Placement Programs Detailed Procedure

40 Private Placement Memorandum Templates Word Pdf

Private Placement Program Ppp These Programs Provide The Traders With Fresh Funds That Produce High Profit Margins Pdf Free Download

General Ination On Ppp Private Placement Program Doc Template Pdffiller

0 komentar

Posting Komentar